6 Ways to Use a Crypto Exchange Aggregator and Save on Swaps

You’ve probably been there: you want to trade some crypto, so you log into your go-to exchange, check the rate, and hit go. Simple enough, right?

Here’s the catch – that rate you just accepted might not be the best one available. In fact, it almost certainly isn’t. Different exchanges price the same crypto pairs differently, sometimes by a fraction of a percent, sometimes by a lot more. And unless you’re manually checking five different platforms before every trade, you’re leaving real money on the table.

That’s the core problem a crypto exchange aggregator solves. Instead of showing you one rate from one exchange, an aggregator pulls rates and liquidity from multiple exchange partners at the same time, then lets you pick the best option. No extra tabs, no separate accounts, no guesswork.

Swapzone is a crypto exchange aggregator that works with 18+ partner exchanges and covers over 1,600 cryptocurrencies. It’s non-custodial – your funds never pass through Swapzone – and requires no KYC for swap transactions. The platform has earned a 4.7/5 rating on Trustpilot, built on one clear idea: show you the best available rate across multiple exchanges, every time.

Below, we break down six real-world use cases where an aggregator gives you a clear edge over sticking with a single exchange – from getting the best deal on a quick crypto trade to building apps that need exchange functionality. These are the scenarios where an aggregator wins.

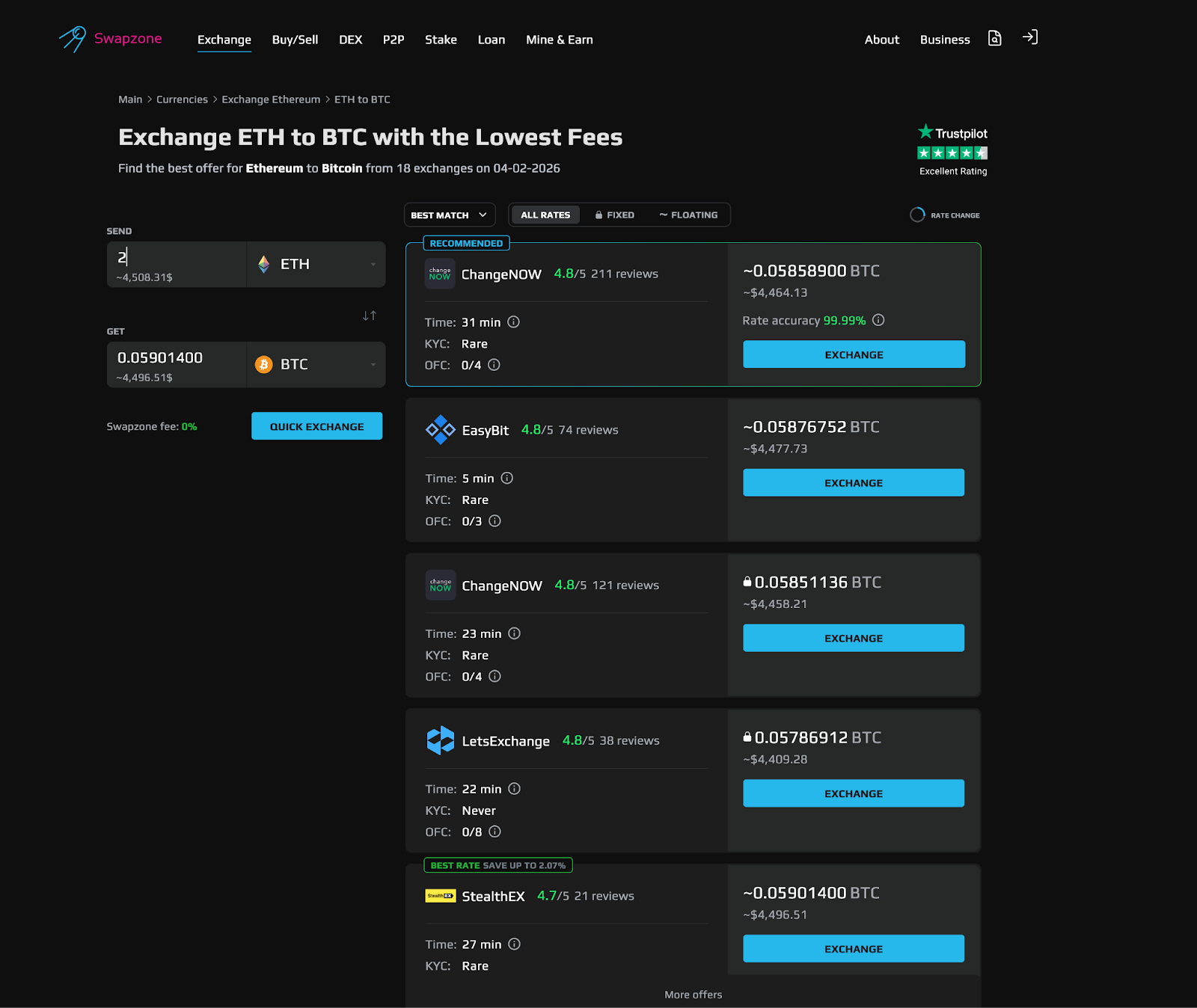

Use Case 1: Getting the Best Rate Across Multiple Exchanges

The most direct win – and also the most common reason people start using an exchange aggregator.

On a single crypto exchange, you get one rate for any given pair. That’s the only option on the table. You might assume it’s competitive, but without checking other platforms, you’d never actually know. And manually comparing five exchanges every time you want to trade? Nobody does that.

Swapzone does the checking for you. It pulls live exchange rates from 18+ partner exchanges at once. When you enter a swap – say BTC to ETH – you see multiple offers ranked by price. You pick the best one.

Here’s why this matters more than people realize: rates aren’t static, and they don’t move in lockstep across exchanges. At any given moment, one exchange might have the edge on a BTC/ETH pair, while another wins on a different crypto pair entirely. On larger trades, even a 0.5% rate difference adds up fast. Across dozens of transactions over weeks and months, that gap compounds into real, measurable savings. You’re not blindly trusting one exchange’s pricing anymore – you’re picking the best deal across the market.

The real win: A single exchange can only show you one rate. An aggregator shows you the whole market – and you pick the best one.

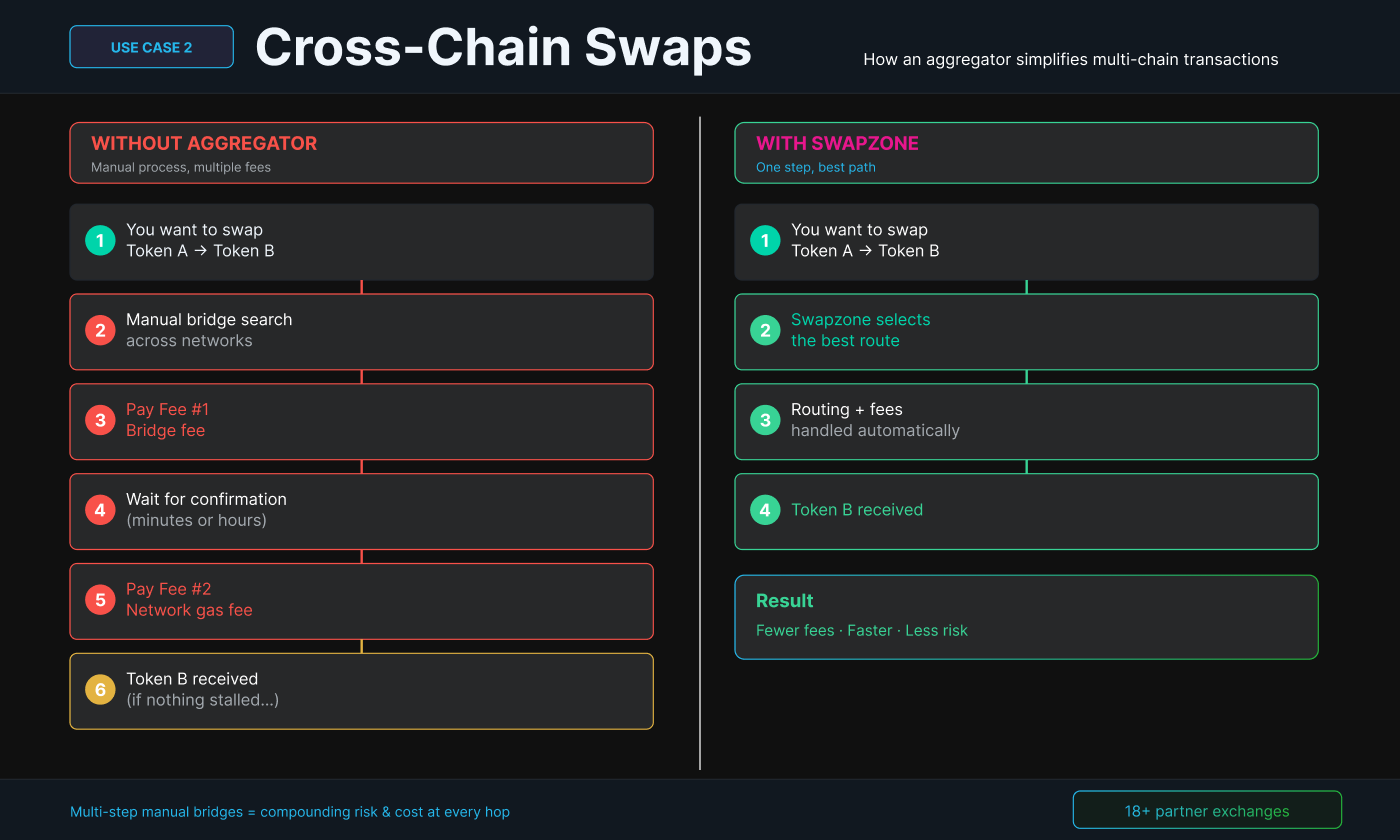

Use Case 2: Simplifying Cross-Chain Crypto Swaps

The crypto ecosystem now runs across dozens of blockchains. Tokens live on Ethereum, Solana, Avalanche, and many other networks. Moving digital assets between these chains used to be a painful multi-step process – find the right bridge, confirm it supports your specific tokens, pay fees at every hop, and hope nothing stalls.

This is one of the areas where an aggregator earns its place. Swapzone’s DEX aggregator handles cross-chain routing behind the scenes. You enter your starting crypto, pick your target crypto, and the platform works out the best path. It could be a direct swap, a bridge, or a combination of both – the routing logic is handled for you.

What used to require juggling multiple platforms and crypto wallets now happens in a single interface. You don’t need to research which bridge works best for which chain. That’s the aggregator’s job, not yours.

The real win: Cross-chain crypto swaps shouldn’t require technical expertise. An aggregator turns a multi-step process into one clean transaction.

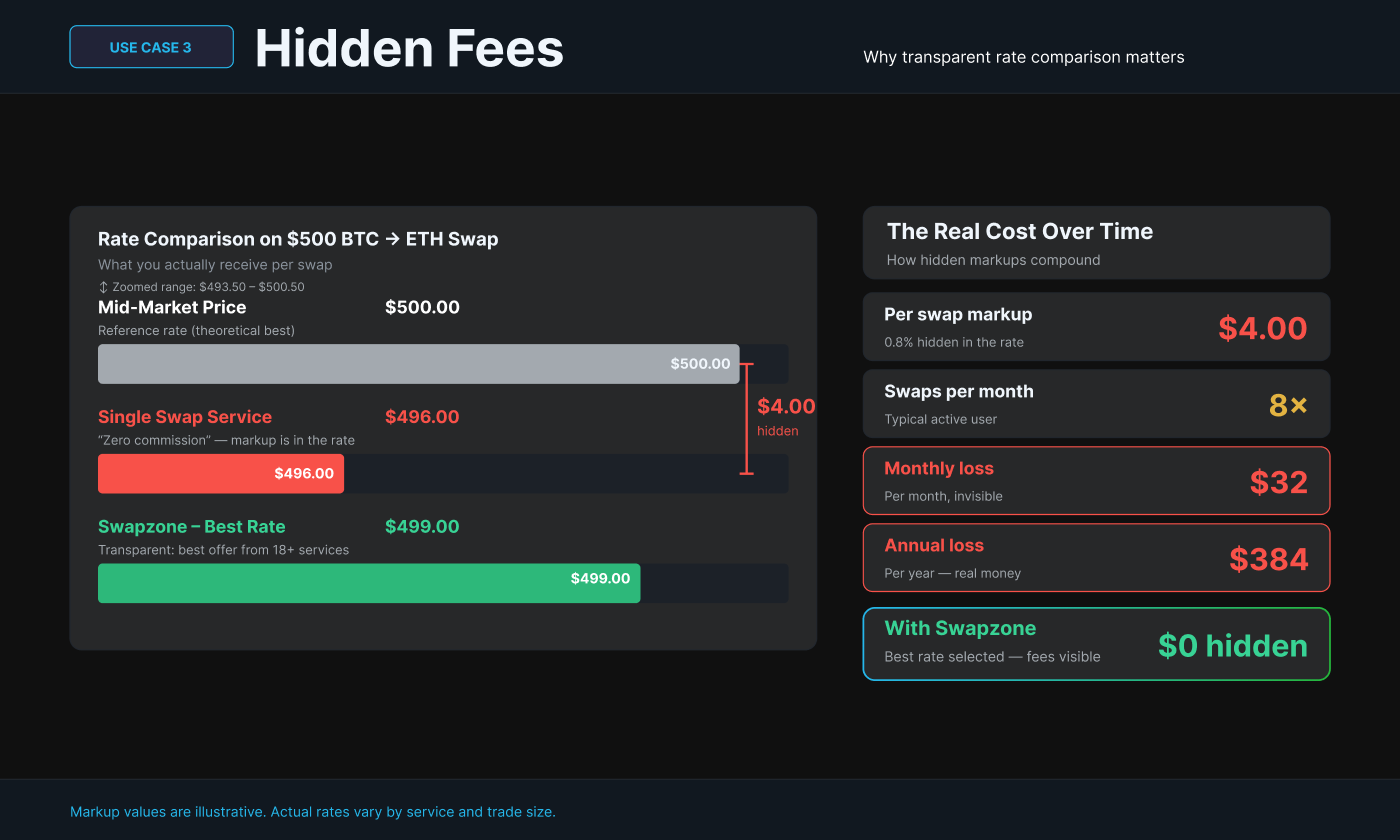

Use Case 3: Avoiding Hidden Fees and Bad Rates on Single Swap Services

This is the one most users don’t think about – but it costs them the most.

A lot of instant exchange services quietly mark up the rate itself, rather than charging an explicit fee. They might advertise “zero commission,” but the rate they offer is worse than the mid-market price. You’re paying more on every trade – you just don’t see it as a line item. The only way to catch this is to compare rates from a different source.

This is where aggregators have a structural edge. When Swapzone shows you offers from multiple partner services side by side, you can actually see the differences. One service might show slightly better pricing but charge a visible fee. Another might do the opposite. You choose based on real data, not just whatever default rate happened to be in front of you.

Real users have noticed this. One Swapzone user pointed out that the platform let them see “familiar names and compare prices between them” – something that’s simply not possible when you’re stuck with a single swap service. That kind of transparent rate comparison is the baseline on an aggregator, not a bonus.

The real win: Hidden fees survive because there’s nothing to compare them against. An aggregator makes the comparison automatic.

Use Case 4: Comparing Instant Crypto Exchange Options in One Place

Speed matters in crypto markets. Rates shift constantly, and if your exchange is slow to process or has a confusing interface, you might end up with a worse rate by the time you actually complete the transaction.

Instant crypto exchange services – platforms that process transactions in minutes rather than hours – have become the standard. But they’re not all built the same way. Some are faster for specific pairs, some carry better liquidity on certain tokens, and some perform better on specific blockchains. Picking the right one for a given trade used to mean signing up for multiple services and testing them one by one.

Swapzone brings all of these instant exchange options into one dashboard. You see processing times, rates, and available offers at a glance – no need to create accounts on five different services just to compare. And because Swapzone is non-custodial, your digital assets stay under your control the whole time. You’re simply using the platform to find and execute the best deal.

The real win: Comparing instant exchanges one by one wastes time. An aggregator does the comparison work for you.

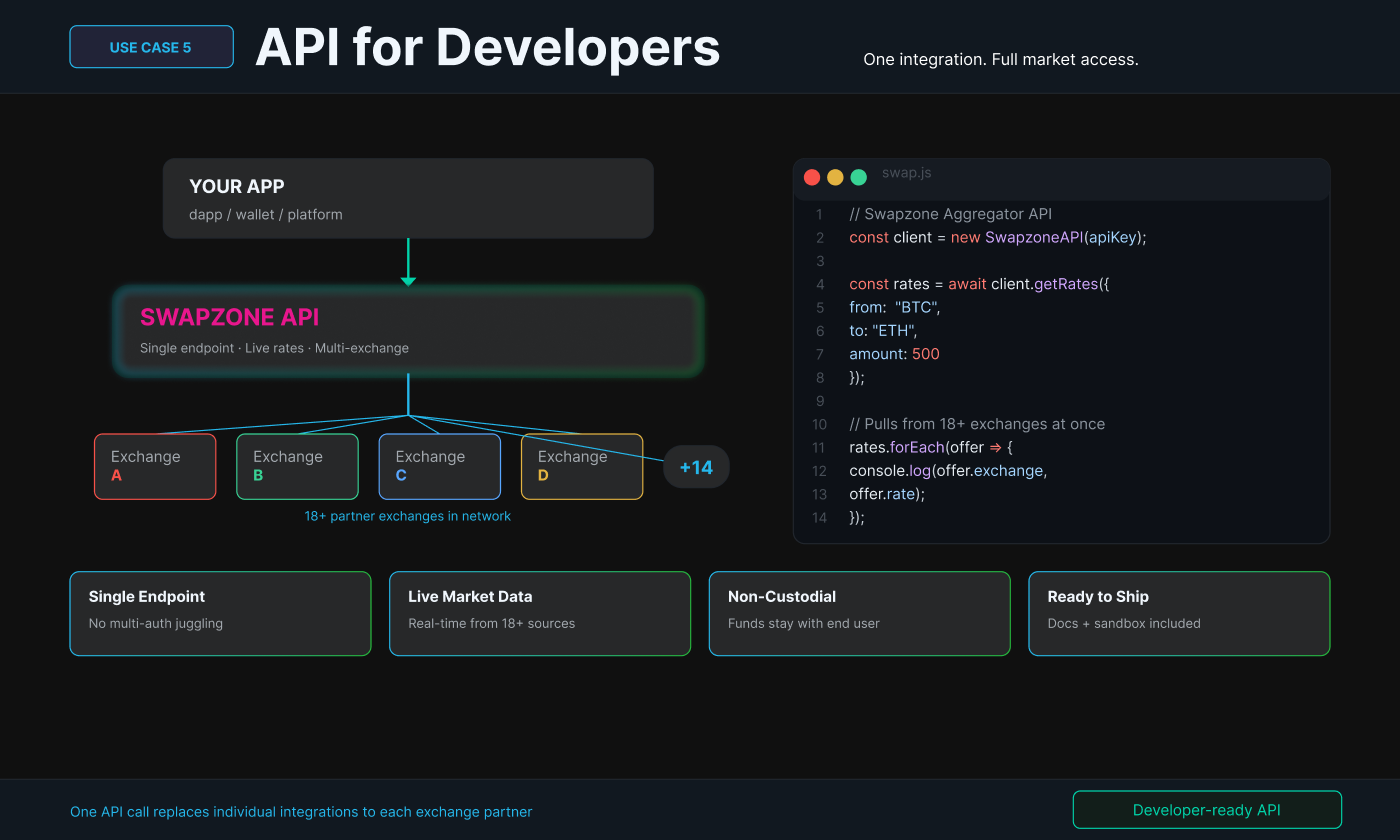

Use Case 5: Integrating a Crypto Exchange Aggregator API for Developers

If you’re building a dapp, a crypto wallet, or any application that needs to offer exchange functionality, connecting directly to multiple exchanges is a serious engineering challenge. Every partner runs its own interface, its own authentication flow, and its own rate limits. Scale that across 10+ exchanges and you’ve got a project that’s slow to build and even slower to maintain.

A crypto exchange aggregator API turns that into a single integration. Developers get one endpoint that already pulls live market data and rates from multiple exchange sources. Swapzone’s API gives access to rates, liquidity, and trade execution across its network of 18+ partner exchanges – without building individual connections to each one.

This is useful for DeFi projects and wallet teams that want to give their users the best available rates without becoming exchange infrastructure experts. Wire up one connection, and your app has access to the same multi-exchange rate comparison that Swapzone users see on the main platform.

The real win: Building exchange integrations from scratch is slow and expensive. An aggregator API cuts it down to one clean connection.

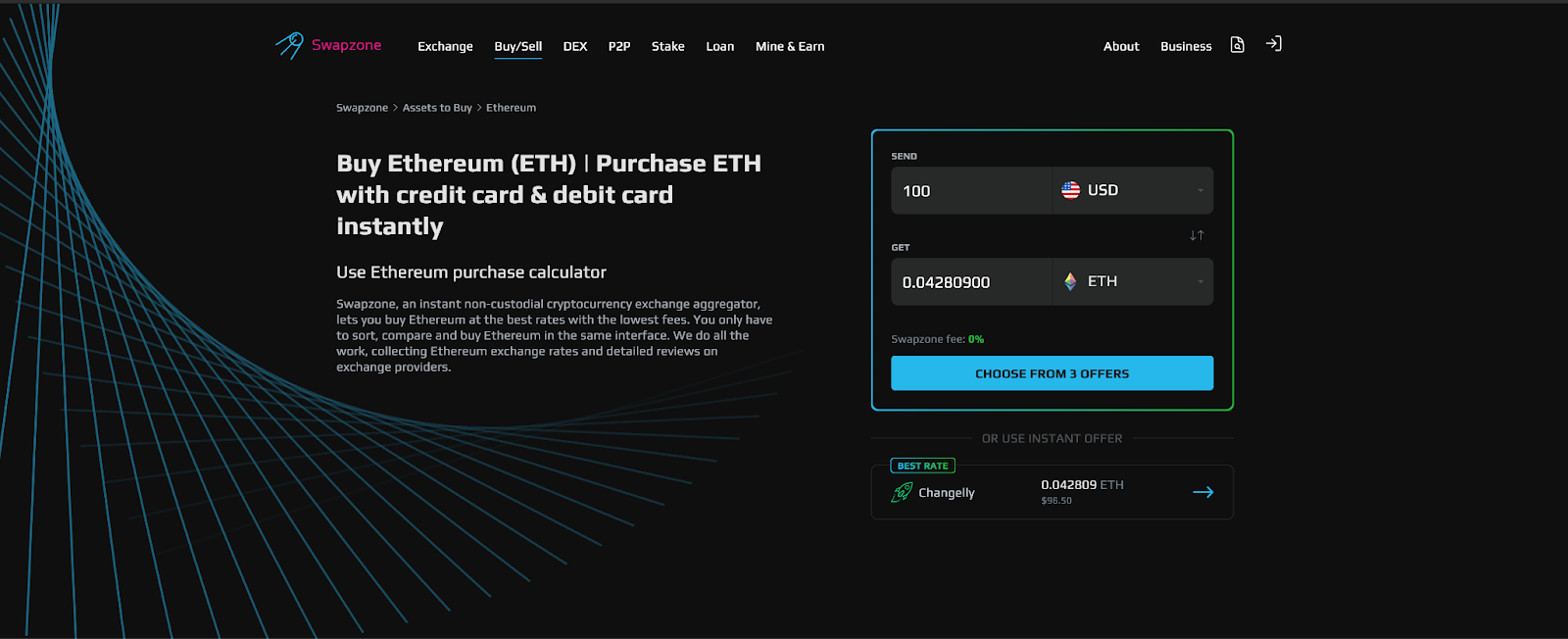

Use Case 6: Buying Crypto and Bitcoin Without Switching Platforms

Getting into crypto for the first time usually involves a frustrating chain of steps: find an exchange that accepts your payment method, create an account, go through KYC verification, fund your wallet – and only then can you actually buy something. That’s a lot of friction before you own a single coin.

Swapzone brings buy crypto options into the same interface where trades happen. You can buy bitcoin with fiat or trade one cryptocurrency for another without hopping between platforms. For transactions done via swap, there’s no KYC required – a big advantage for users who value speed and privacy.

This means you don’t need accounts scattered across multiple platforms just to stay active in the market. One place to compare rates, one place to buy, one place to swap. For anyone building or growing a crypto wallet, that simplicity saves a lot of unnecessary back-and-forth.

The real win: Buying crypto should be a one-stop process, not a multi-platform tour. An aggregator keeps it that way.

Why an Aggregator Beats a Single Exchange – Every Time

Six use cases, one clear pattern: a single crypto exchange gives you limited information and limited options. A crypto exchange aggregator gives you both.

Swapzone pulls rates from 18+ partner exchanges, supports over 1,600 digital assets, and runs on a non-custodial, no-KYC basis for swaps. You see what you’re paying. You pick the best deal. And you’re not wasting time comparing platforms manually – the aggregator handles that for you.

From getting the best rate on a Bitcoin swap to building apps with an aggregator API, the advantage is the same across the board: more options, better visibility into pricing, and more control than any single exchange can deliver.

If you want to compare the best rates and swap options in one place, try Swapzone.