Workflow Orchestration for Agentic AI: Governing Execution at Scale

As banks move from experimenting with individual AI agents to deploying them across real business workflows, a clear pattern emerges. Early pilots succeed. Scaling efforts stall. The issue is rarely model quality. It is coordination.

When multiple agents interact — sharing data, triggering actions, and escalating outcomes — the primary risk shifts from what a model generates to how work is executed across systems, people, and controls. In regulated environments, ungoverned execution quickly becomes unacceptable.

This is where workflow orchestration matters. Orchestration does not make agents smarter. It makes them governable. It defines how agents coordinate, where human approval occurs, how exceptions are handled, and how decisions can be traced end to end.

In banking, orchestration is not an optimization layer. It is the mechanism that embeds agentic execution inside enterprise workflows governed by policy, regulation, and accountability.

Agentic systems combine reasoning, action, and orchestration. Most discussions focus on the first two — this article focuses on the third.

1 Execution vs. Orchestration: A Necessary Distinction

Once banks move past single-agent pilots, the distinction between execution and orchestration becomes critical. The terms are often used interchangeably, but they serve different roles in an agentic system.

Agent frameworks govern execution. They define how an individual agent plans tasks, invokes tools, handles failures, manages state, and determines when work is complete. Execution answers a narrow question: How does this agent perform its assigned task?

Orchestration governs coordination. It defines how multiple agents work together within a broader business workflow — how tasks are sequenced, when agents run in parallel, where approvals occur, how exceptions are escalated, and how outcomes are audited. Orchestration answers a different question: How is work governed across agents, systems, and people?

This distinction becomes essential in regulated environments. A mortgage underwriting agent may verify income accurately. Another may assess collateral risk. A third may draft pricing terms. Without orchestration, these agents operate as isolated workers. With orchestration, they become part of a governed system that enforces policy, sequencing, and accountability.

Orchestration does not make agents smarter. It makes them accountable. It embeds agent execution inside enterprise workflows shaped by regulatory requirements, organizational authority, and audit expectations. Orchestration separates how work is done from how work is governed — a separation traditional automation platforms already enforce, and agentic systems must now replicate.

2 The Business Case: Quantifying Orchestration Value

The value of orchestration extends beyond operational efficiency. It changes how quickly banks can adapt and scale as agentic systems move into production. Recent implementations show returns that justify investment in orchestration infrastructure.

2.1 Timeline Acceleration

McKinsey research reveals that orchestrated agent systems can accelerate technology modernization timelines by 40–50% while reducing costs by more than 40%[4]. One global bank achieved even more dramatic results, cutting its IT modernization timelines by over 50% by deploying orchestrated agents to assist engineering teams[3]. This acceleration comes not from individual agent performance but from eliminating handoff delays and coordination overhead.

2.2 Efficiency Gains at Scale

Boston Consulting Group’s analysis of advanced multi-agent implementations shows that when agents collaborate across processes through proper orchestration, organizations achieve 30–50% improvements in efficiency and execution speed[1]. These gains compound as workflows become more complex — the very scenarios where traditional automation fails.

2.3 Operational Transformation

Financial institutions implementing multi-agent orchestration for specific workflows report transformative outcomes:

- KYC Processing: Deloitte research documents multi-agent KYC workflows reducing onboarding time from days to minutes, with agents handling document verification, risk scoring, and regulatory filing in parallel[2].

- Credit Analysis: Banks report 60% productivity gains for credit analysts when orchestrated agents handle memo generation, risk assessment, and documentation[3].

The true value emerges when orchestration enables what was previously impossible. This shift — from incremental improvement to end-to-end process transformation — is where orchestration delivers exponential returns.

3 Core Orchestration Patterns in Agentic Systems

As agentic systems scale, banks converge on a small number of orchestration patterns. These patterns determine how work is coordinated — not how agents reason.

Workflows must be configurable, interruptible, and reversible[10]. In banking, this means policies can be updated without rewriting agent code, processes can pause for human review or external events, and transactions can be unwound if errors are detected downstream. These properties are not optional in regulated environments — they are fundamental requirements for trustworthy orchestration.

3.1 Sequential Handoffs

Sequential handoffs enforce strict order and control in workflows where steps must occur linearly. In regulated processes like underwriting, where order is dictated by policy, this pattern prioritizes predictability and auditability over speed.

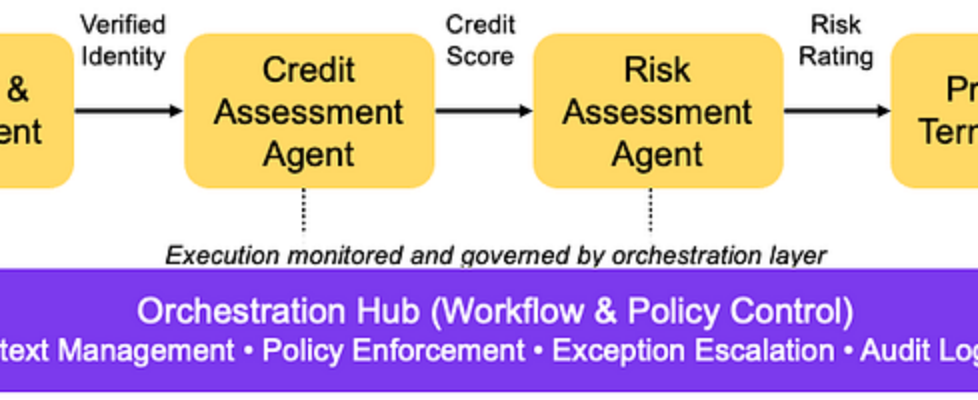

Figure 1: Sequential orchestration with deterministic handoffs. A centralized orchestration layer enforces strict execution order, auditability, and control across regulated workflows such as underwriting.

3.2 Parallel Fan-Out and Aggregation

Fan-out orchestration compresses cycle time by running independent analyses simultaneously while preserving a single decision point. Instead of waiting for serial processing, agents analyze income, collateral, and market conditions in parallel, with outputs aggregated for a final decision.

Figure 2: Parallel fan-out orchestration with aggregation. Independent analyses run in parallel under centralized orchestration, with results reconciled and escalated before a single, governed decision.

3.3 Supervisor–Worker Models

The supervisor–worker model introduces specialization without fragmenting accountability. A coordinating supervisor assigns work to domain-specific agents — credit analysis, compliance, pricing — while retaining control over execution flow, escalation, and policy enforcement.

3.4 Event-Driven Execution

Event-driven execution replaces linear workflows with trigger-based coordination. Agents respond to external signals — such as market movements or fraud alerts — in real time, rather than waiting for scheduled process steps. Because execution is reactive, this pattern requires strict guardrails to prevent uncontrolled cascades.

Figure 3: Event-driven orchestration for proactive credit offers. External triggers initiate governed workflows, with parallel agent analysis coordinated through centralized policy control and human escalation for high-risk cases.

3.5 Branching and Conditional Routing

Branching applies differentiated treatment based on risk or complexity within a single workflow. The orchestration engine evaluates each request and routes it accordingly — standard cases to automated advisory agents, higher-risk cases to human-augmented review paths.

Figure 4: Branching and conditional routing for tiered client service. Requests are classified by risk and complexity, then routed by the orchestration engine — standard cases flow through automated advisory agents, while high-touch cases escalate to human-augmented review.

This pattern is especially effective in scenarios requiring differentiated service levels or risk-based processing. It allows banks to preserve efficiency for routine cases while ensuring complex scenarios receive appropriate scrutiny — without fragmenting workflows or bypassing governance. Importantly, the branching decisions themselves become auditable control points, providing clear documentation of why specific cases received different treatment.

4 System Orchestration Maturity

Understanding where your organization stands is critical for planning an orchestration journey. This section introduces two complementary lenses: system-level workflow orchestration maturity, and individual agent capability.

4.1 System Workflow Maturity

LevelStageCharacteristicsExamplesTechnologyGovernanceLevel 1Single-Agent TasksIndividual agents handle discrete, well-defined tasks. No coordination between agents.Document classification, data extraction, simple Q&ABasic LLM integration, simple API callsManual oversight of each agent outputLevel 2Sequential HandoffsAgents work in predefined sequences. Output from one becomes input to the next.Loan application processing, compliance review workflowsWorkflow engines, basic orchestration frameworksCheckpoint approvals between stagesLevel 3Parallel ExecutionMultiple agents work simultaneously on different aspects of the same problem.Multi-source risk assessment, integrated market analysisAdvanced orchestration platforms (AWS Agent Squad, Semantic Kernel)Consolidated review points, exception handlingLevel 4Dynamic OrchestrationWorkflows adapt based on intermediate results and external events.Real-time fraud response, adaptive customer serviceEvent-driven architectures, intelligent routingPolicy-based guardrails, automated escalationLevel 5Self-Organizing NetworksAgents autonomously form teams and workflows based on objectives.Complex trading strategies, enterprise-wide optimizationEmergent AI systems, swarm intelligenceOutcome-based controls, continuous monitoring

4.2 Individual Agent Capability

This framework complements system workflow maturity by focusing on individual agent capability rather than workflow governance.

LevelTypeCapabilityOrchestration RoleL1ChatbotsSimple response generation without tool useNo orchestration neededL2ReasonersAnalyze and solve problems systematicallyLimited orchestrationL3AgentsInteract with environments through toolsOrchestration becomes criticalL4InnovatorsLearn and create new capabilitiesOrchestration enables emergenceL5OrganizationsFully autonomous systems operating independentlyOrchestration IS the organization

Most banks today operate at L2, experimenting with L3. Effective orchestration is what enables progress beyond experimentation toward coordinated, governed execution.

5 Human Review Happens at Workflow Boundaries

A common misconception in agentic AI discussions is that human-in-the-loop means humans supervising every agent action. This model does not scale — and in regulated environments, it is neither necessary nor desirable.

In well-designed agentic systems, humans focus on reviewing outcomes rather than supervising individual execution steps. Orchestration defines explicit checkpoints where human judgment is required, while allowing agents to execute preparatory and analytical work autonomously within those boundaries.

This mirrors how banks already operate. Credit officers do not manually verify every document or calculation; they review synthesized information, assess exceptions, and approve decisions. Agentic systems simply automate the work leading up to that judgment point.

Orchestration determines where approvals are required, who has authority to approve or override outcomes, what evidence is presented, and how decisions are logged and audited — turning human review into a governed control point rather than an execution bottleneck.

6 Common Pitfalls: Learning from Failed Orchestrations

Orchestration failures rarely stem from model errors. They emerge when ownership, escalation authority, and decision rights are left implicit as agents operate across workflows. The pitfalls below surface once agentic systems move beyond pilots and into real operational use.

6.1 Agent Washing

The Problem: Organizations label systems as “multi-agent” even when there is no real coordination, decision-making, or accountability. This is often just traditional automation wrapped in new terminology, creating a false sense of AI maturity.

The Solution: True orchestration coordinates real agents — each with a defined role — by sharing context, routing work intelligently, and enforcing governance. If a “supervisor” simply runs predefined steps in sequence, the system may be automated, but it is not genuinely agentic.

6.2 Over-Engineering Simple Workflows

The Problem: Teams build complex multi-agent orchestrations for tasks that a single agent — or even traditional automation — could handle effectively.

The Solution: Start with single agents for well-defined tasks. Only introduce orchestration when you need parallel processing, dynamic routing, or complex state management. Complexity should be justified by measurable benefits.

6.3 Insufficient Audit Trails

The Problem: Orchestration obscures the decision path, making it impossible to understand why a particular outcome was reached or which agent contributed what insight.

The Solution: Build complete logging from day one. Every agent interaction, data transformation, and routing decision must be captured. In regulated environments, the audit trail is as important as the outcome itself.

6.4 Missing Exception Handling

The Problem: Orchestrations fail catastrophically when agents return unexpected results or when external systems become unavailable.

The Solution: Design for failure. Define explicit fallback paths, timeout policies, and escalation procedures. Every orchestration should gracefully degrade rather than halt entirely.

6.5 Rigid Human Escalation

The Problem: Systems require human intervention for every edge case, creating bottlenecks that eliminate efficiency gains.

The Solution: Implement intelligent escalation that considers context, risk levels, and business impact. Low-risk exceptions might proceed with logging; high-risk scenarios trigger immediate human review.

6.6 Poor Performance Monitoring

The Problem: Teams lack visibility into orchestration performance, making it impossible to identify bottlenecks or optimize workflows.

The Solution: Instrument every aspect of orchestration — agent response times, queue depths, error rates, and business metrics. Real-time dashboards should show both technical and business KPIs.

6.7 Underestimating Production Complexity

The Problem: Teams successfully demonstrate orchestrated agents in controlled environments, only to face cascading failures when workflows hit production scale. What works for 10 workflows per day breaks at 10,000.

The Solution: Address core production challenges from the start:

- State Management: Banking workflows like loan origination span days or weeks. Orchestration must maintain state across system restarts, agent failures, and infrastructure changes. Implement persistent state stores with versioning and recovery capabilities.

- Fault Isolation: When one agent in an orchestrated workflow fails, the entire system shouldn’t collapse. Design orchestration with circuit breakers (automatic stops that prevent cascade failures) — if the fraud detection agent is down, route to enhanced manual review rather than halting all loan processing.

- Timeout Discipline: Anthropic’s research system enforces 30–180 second timeouts per agent depending on task complexity[6]. Banks must similarly bound execution — a credit analysis agent that runs indefinitely defeats automation’s purpose. Set aggressive timeouts with graceful degradation.

- Debugging Complexity: Debugging orchestrated systems differs entirely from traditional software. A single workflow might involve dozens of agent interactions, making root cause analysis challenging. Build detailed logging from day one, with the ability to replay exact workflows with point-in-time data.

- Cost Control at Scale: Multi-agent workflows can generate massive API costs if not carefully managed. Implement token optimization, intelligent caching of expensive operations, and tiered processing (simple models for routine tasks, advanced models only when necessary).

Production-ready orchestration requires engineering discipline equal to any mission-critical system. The elegance of agent coordination means nothing if the system fails under real-world load.

7 Orchestration as the Control Plane

Figure 5: A centralized orchestration layer governs state, routing, guardrails, and escalation across specialized agents, while human decision points, auditability, and policy enforcement define authority. Systems of record remain the authoritative enterprise platforms.

This control-plane model separates governance from execution — keeping agentic workflows auditable, interruptible, and accountable at scale.

As workflows stretch across days or weeks, orchestration manages state — allowing processes to pause, resume, or replay while remaining fully auditable. Because state is persistent and inspectable, orchestration evolves from a coordination mechanism into the governing layer that determines how work is initiated, carried through, reviewed, and ultimately audited across agents.

Orchestration provides four critical capabilities:

- State and Context Management ensures continuity across long-running workflows, tracking what has completed, what is pending, and what conditions must be met next.

- Policy Enforcement and Guardrails ensure that agents operate only within approved boundaries, enforcing escalation rules, thresholds, and separation of duties.

- Exception Handling and Escalation define how systems respond when cases deviate from the expected path, preventing silent failures or uncontrolled loops.

- Auditability and Replayability create a complete execution record — critical for regulatory review, investigation, and continuous improvement.

7.1 Implementing Guardrails Across the Orchestration Layer

Effective orchestration requires multiple types of guardrails operating in concert[10]:

Input Guardrails: Screen requests before they reach agents — blocking prompt injections, PII leakage attempts, and requests that violate policy. In banking, this includes sanctions screening, authentication validation, and regulatory compliance checks at workflow initiation.

Output Guardrails: Validate agent responses before they reach downstream systems or users — ensuring accuracy, preventing disclosure of sensitive information, and blocking regulated advice without proper authorization.

Execution Guardrails: Monitor and constrain agent actions during workflow execution — enforcing transaction thresholds, rate limits, geographic and time-based restrictions, and automatic halts when agents operate outside authorized boundaries.

Model-Level Guardrails: Ensure AI models behave reliably in regulated contexts — maintaining factual accuracy, consistency across responses, and detecting model drift that could impact risk or compliance.

In banking orchestration, these guardrails are not merely safety features — they are compliance requirements. Each guardrail type generates audit events, creating the regulatory trail that distinguishes governed orchestration from ungoverned automation.

7.2 Measuring Orchestration Effectiveness

Evaluation is the cornerstone of successful agent development. For orchestration specifically, success metrics differ from individual agent performance. Banks must measure the orchestration layer’s unique contribution to system reliability and business outcomes.

7.2.1 Orchestration-Specific Metrics:

Workflow Completion Rate: Percentage of workflows reaching successful conclusion without manual intervention. Target: >90% for routine workflows, >60% for complex cases.

Handoff Success Rate: Percentage of successful data and context transfers between agents. Each failed handoff represents orchestration failure, not agent failure. Target: >99.5%.

Orchestration Overhead: Time added by orchestration (routing decisions, state management, guardrail checks) versus direct agent execution. Target: <10% for sequential workflows, <25% for complex parallel workflows.

System-Level Accuracy Improvement: How orchestration improves overall accuracy compared to individual agent performance. Anthropic’s research system achieved 95%+ system accuracy with 90% component accuracy through orchestrated verification loops[6].

Cost per Orchestrated Workflow: Total compute, API, and infrastructure costs divided by successful workflow completions. Critical for ROI calculations.

Recovery Success Rate: Percentage of workflows that successfully recover from agent failures or timeouts through orchestration-managed fallbacks.

7.2.2 Business Impact Metrics:

Time-to-Decision Reduction: How much faster orchestrated workflows complete versus manual processes (e.g., loan approvals in hours versus days)

Compliance Rate: Percentage of orchestrated workflows meeting all regulatory requirements without manual correction

Operational Cost Savings: Reduction in human hours required per workflow

Customer Experience Scores: Improvement in satisfaction from faster, more consistent service

These metrics create feedback loops for continuous improvement. Orchestration that doesn’t demonstrate measurable improvement across these dimensions isn’t delivering value — regardless of individual agent sophistication. Leading banks are already proving these concepts in production — not just in pilots.

8 Real-World Implementations in Banking

Leading banks are already deploying orchestrated agent systems without replacing core infrastructure — providing practical lessons for institutions planning their own orchestration strategies.

8.1 Modular Overlay Approach

Metro Bank successfully deployed Covecta-powered lending agents without modifying its core loan origination system[5]. The orchestration layer sits above existing infrastructure, intercepting workflows at key decision points and returning enriched decisions back to legacy systems. This approach delivered immediate value while preserving system stability.

8.2 Platform Enhancement Strategy

JPMorgan Chase utilizes a “Supervisor Agent” architecture to power its “Ask David” investment research platform[12]. In this model, a central supervisor agent acts as the orchestrator, interpreting complex advisor queries and delegating tasks to specialized sub-agents — one for querying structured financial data (SQL), another for retrieving internal strategy documents (RAG), and a third for generating analytics curves. The supervisor then aggregates these distinct outputs into a single, compliant response, ensuring that no single agent operates without oversight.

8.3 Legacy Modernization Acceleration

Large-scale legacy modernization shows why orchestration matters for agentic execution. Rather than automating COBOL migration end to end, teams break the work into coordinated, agent-driven stages. Microsoft’s COBOL Agentic Migration Factory is a clear example: specialized agents handle code analysis, dependency mapping, translation, test generation, and validation, while an orchestration layer sequences execution, maintains state across iterations, and enforces quality gates[13]. When confidence thresholds are not met, workflows pause for human review before resuming. The result is faster modernization without sacrificing control, auditability, or engineering rigor.

8.4 Cross-Functional Orchestration

Cross-functional orchestration extends agentic systems beyond individual workflows and into enterprise operations. In complex workflows, agents may span risk, compliance, legal, and relationship management, coordinated through a central orchestration layer that maintains context and enforces policy across organizational boundaries.

Across these implementations, several common success factors emerge:

- Start with high-value use cases where orchestration directly affects risk, compliance, or customer decisions.

- Expand orchestration incrementally, rather than attempting enterprise-wide rollout upfront.

- Define explicit human approval points for decisions that carry regulatory or financial exposure.

- Instrument orchestration with audit, replay, and performance monitoring from day one.

- Treat orchestration as shared infrastructure, not a one-off delivery initiative.

9 Build vs. Buy in an Agentic World

Scaling agentic AI raises a practical question: what should we build, and where should we partner?

Banks should own orchestration logic that encodes policy, governance, and accountability — workflow structure, approval points, escalation rules, and audit requirements. These reflect institutional knowledge and must evolve with regulation and risk appetite.

Vendors add value where capabilities are horizontal and repeatable: workflow engines, case management, observability, and enterprise integrations. These platforms provide reliable scaffolding without dictating business logic.

Banks do not need to replace existing systems to adopt agentic AI. The orchestration layer can operate alongside traditional workflows, enabling gradual migration and reducing transformation risk. This allows banks to preserve what already works while selectively introducing agent-based capabilities where they add the most value.

The right balance combines vendor infrastructure with in-house ownership of governance and decision boundaries. This hybrid approach allows banks to move at different speeds across different domains — aggressive in customer service, cautious in risk management — while maintaining a coherent orchestration strategy.

10 Conclusion

Orchestration does not make agents more intelligent — it makes them governable. It defines how agents interact, where human judgment is required, how exceptions are handled, and how regulators can trace decisions end to end.

Evidence from early adopters shows that banks implementing orchestrated multi-agent systems are achieving 40–50% acceleration in modernization timelines[4], 30–50% efficiency gains in complex workflows[1], and millions in documented savings[3]. More importantly, they are building the foundation for continuous adaptation in an AI-driven future.

The formula is clear: Agent = LLM + Tools + Orchestration. While the industry races to improve the first two components, the third remains the key differentiator. Agent frameworks determine how work gets done. Orchestration is what makes that work trustworthy at scale.

Banks that design orchestration deliberately will not just move faster — they will move with the confidence required by regulation. The constraint on banking adoption is no longer intelligence. It is trust. The winners will not be those with the smartest agents — they will be those with the most governable systems.

11 References and Further Reading

[1] Boston Consulting Group. (2024). Executive Perspectives: Supply Chains Unlocking the Value Potential. https://media-publications.bcg.com/BCG-Executive-Perspectives-Unlocking-Impact-from-AI-Supply-Chains-EP4-7Oct2024.pdf

[2] Deloitte. (2025). How banks can supercharge intelligent automation with agentic AI. https://www.deloitte.com/us/en/insights/industry/financial-services/agentic-ai-banking.html

[3] McKinsey. (2025). Seizing the agentic AI advantage. https://www.mckinsey.com/capabilities/quantumblack/our-insights/seizing-the-agentic-ai-advantage

[4] McKinsey. (2025). The change agent: Goals, decisions, and implications for CEOs in the agentic age. https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-change-agent-goals-decisions-and-implications-for-ceos-in-the-agentic-age

[5] Everest Group. (2025). Banking on Autonomous Agents: Embracing Agentic AI in Financial Services. https://www.everestgrp.com/blog/banking-on-autonomous-agents-embracing-agentic-ai-in-financial-services-blog.html

[6] Anthropic. (2024). How we built our multi-agent research system. https://www.anthropic.com/engineering/multi-agent-research-system

[7] AWS. (2025). Agentic AI in Financial Services: Choosing the Right Pattern for Multi-Agent Systems. https://aws.amazon.com/blogs/industries/agentic-ai-in-financial-services-choosing-the-right-pattern-for-multi-agent-systems/

[8] Microsoft. (2024). AI Agent Orchestration Patterns. https://learn.microsoft.com/en-us/azure/architecture/ai-ml/guide/ai-agent-design-patterns

[9] Microsoft. (2025). Semantic Kernel: Multi-agent Orchestration. https://devblogs.microsoft.com/semantic-kernel/semantic-kernel-multi-agent-orchestration/

[10] OpenAI. (2024). A Practical Guide to Building Agents. https://cdn.openai.com/business-guides-and-resources/a-practical-guide-to-building-agents.pdf

[11] McKinsey. (2025). The agentic organization: Contours of the next paradigm for the AI era. https://www.mckinsey.com/capabilities/people-and-organizational-performance/our-insights/the-agentic-organization-contours-of-the-next-paradigm-for-the-ai-era

[12] C. Rohn. Multi-Agent Frontiers: Building Ask D.A.V.I.D. LangChain Interrupt Conference, 2025. https://cameronrohn.com/docs/discover/LangChain-Interrupt-2025/presentations/2.4-Multi-Agent-Frontiers-Building-Ask-D.A.V.I.D/

[13] Microsoft. (2024). How We Use AI Agents for COBOL Migration and Mainframe Modernization. https://devblogs.microsoft.com/all-things-azure/how-we-use-ai-agents-for-cobol-migration-and-mainframe-modernization/

Workflow Orchestration for Agentic AI: Governing Execution at Scale was originally published in Towards AI on Medium, where people are continuing the conversation by highlighting and responding to this story.